Staying ahead of shifts in Wealth Management

Now in it’s 10th year, the Digital Integration in Wealth Management Conference brings together 300+ senior leaders from private banks, wealth managers, asset managers and FinTech innovators to shape the future of digital wealth.

Across two days, this flagship event delivers cutting-edge insights into AI, onboarding, client experience, regulatory change, cybersecurity and next-generation investment models.

- Understand the next wave of AI transformation

From agentic AI to automated onboarding, analytics and hyper-personalisation. - Stay ahead of regulatory disruption

DORA, TLPT, data privacy and technology accountability – explained by experts. - Build experiences that win digital-native clients

Discover the behaviours, expectations and investment preferences of Gen Z & Millennials. - Transform your operating model

Hear real case studies on resilience, cybersecurity, compliance and product innovation. - Connect with senior decision makers

12+hours of networking including lunches, roundtables and drinks

Who should attend?

- CEOs’ CIOs, COOs

- Heads of Digital, Data, AI

- Heads of Client Experience

- Wealth and Investment Directors

- Compliance & Risk Leads

- Marketing & CX Professionals

- FinTech & Solution Providers

Secure your place today

Join the industry’s most forward-looking event and connect with leaders shaping the future of digital wealth.

WHAT TO EXPECT FOR 2026?

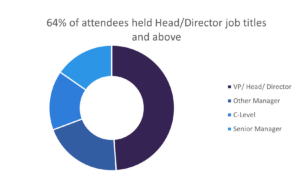

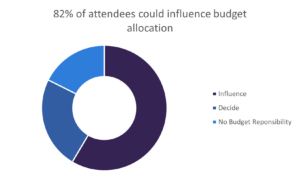

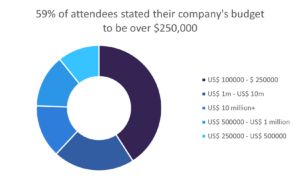

| 300+ Attendees | 25+ Exhibitors to meet | 25+ Talks from high-level speakers | 90% Attendees at Director+ level |

| 300+ Attendees | 25+ Exhibitors to meet | ||

| 25+ Talks from high-level speakers | 90% Attendees at Director+ level |

Back

Back